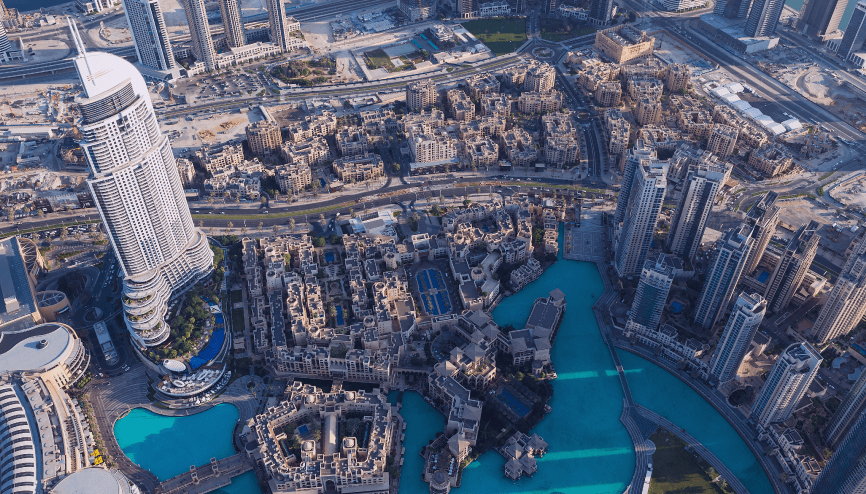

UAE holds a distinct position in the world for its strategic location, which gives it a competitive advantage and serves as the biggest trading center in the Middle East. UAE acts as a regional headquarters for various multinationals owing to the favourable tax systems, investment-friendly laws and incentives, state-of-the-art infrastructure, stable government, and availability of international talent.

Newer initiatives such as Long-term Visas, 100% Ownership in Mainland, and the World Expo 2020 showcases the government’s intent to invest in global businesses and state-of-the-art technologies. These developments attract many multinational companies to the region to expand their businesses and will help them capitalize on the plethora of opportunities available in the region.

UAE is home to 45 Free Zones which are dedicated to various industries and sectors including two of the largest Financial Free Zones in the region – Dubai International Financial Center (DIFC) and Abu Dhabi Global Market (ADGM). These Financial Free Zones host the Top International Banks and Financial Institutions, and is a burgeoning hub for Fintech operations globally.

Nexdigm understands the needs of growing businesses and tailors solutions to meet your unique business needs. We share our deep domain and industry knowledge with clients across all industries. As an end-to-end professional services provider, we advise clients of all sizes on matters related to strategic projects, expansion plans, and managing on-going operations.

Our expertise in handling various compliances globally enables us to leverage experience in navigating newer developments in the regulatory landscape of UAE and the larger GCC region.

We recognize the needs of global businesses as varied, requiring not merely solutions, but holistic integrated solutions. With the help our global network and local experts, we provide services that address all aspects relevant to a business from conceptualization to implementation and continuance.

Transition to the new paradigm of business with the support of subject matter experts who help you Think Next!

what's new

Nexdigm consistently produces thought leadership, publications and updates on the latest developments in the world of business. We strive to provide the information that matters most to professionals across the globe.

Family Foundations in UAE: A Framework and Key Corporate Tax Implications

In the UAE, family foundation is a popular legal structure primarily used by wealthy families and high-net-worth individuals for wealth preserv...

UAE Transfer Pricing: Key Regulations and APA Framework Updates

Transfer Pricing Overview

Transfer Pricing (TP) refers to the pricing of transactions between related entities within th...

Unleashing Potential: AI’s Role in Reshaping M&A Dynamics

In an era marked by unprecedented technological advancements and rapidly evolving business landscapes, the world of M&A is undergoing a profound ...

UAE Transfer Pricing Disclosure: What You Need to Know

The FTA has updated the format of the UAE Corporate Tax return, which now has a specific portion on Transfer Pricing (TP) related disclosure. T...

UAE Corporate Tax Regime: Impact on Free Zone Entities

The UAE Corporate Tax Law (CT Law) is effective for any financial year beginning on or after 1 June 2023 (i.e., for a company following calendar ...

How Holding Companies Could Hold Ground under UAE Corporate Tax

The UAE has long been known for its business-friendly environment, characterized by a lack of corporate and personal tax. However, the UAE’s Fe...

Valuation of Optionally Convertible Debt Instruments

Convertible securities emerged during the nineteenth century in the U.S. This was during a period in which securing capital in a swiftly expanding ...

IFRS vs ASC: Valuation Perspective

This article aims to highlight the key valuation triggers that stem from the application of various International Financial Reporting Standards (IFRS...

TP Guide 2023 – A Disquisition to UAE TP Rules

The UAE Ministry of Finance (MoF) issued the first-ever Transfer Pricing Guide (TPG) on October 2023 to provide general guidance on the Transfer P...

From cost arbitrage to core value drivers: Setting up a successful GCC

Global Capability Centers (GCC) have evolved from cost generators to strategic business enablers and value generators. During the initial stage, th...

Investing in Manufacturing – Top Investment Destinations in Asia

Global markets today are becoming more interconnected with liberalized trade policies, growing access across countries, and increasing bilateral ag...

Corporate Tax Registration of Juridical Persons

The UAE’s Federal Tax Authority (FTA) recently released a guide in August 2023 that will help navigate the Corporate Tax Registration of juridi...

Tax Podcast

EP:07 UAE Corporate Tax and Transfer Pricing

The UAE Corporate Tax and Transfer Pricing implementation requires an in-depth ...

UAE Corporate Tax: ‘Qualifying Income’ Clarified

The UAE Corporate Tax (CT) Law has been implemented effective 1 June 2023. The CT law that was first released in December last year has a spe...

Key considerations for obtaining Tax Registration Number (TRN)

The UAE Corporate Tax law would be effective from 1 June 2023. Corporate Tax shall be imposed on a taxable person at the rate of 9%, subject to cer...

10-Step Checklist for UAE Corporate Tax Implementation

Review of accounting policies and financial statements to ensure they are aligned with the best practices.

Review Group Structure. Assess...

Substance and Value Creation: Important pillars of the UAE CT Regime

The Organization for Economic Co-operation and Development (OECD) has played a key role over the last decade or so with the introduction of key ...

Free zone companies free of Corporate Tax?

UAE makes an attractive investment destination for foreign investors, largely due to its favorable geographical location, economic and political ...

Summary of UAE Corporate Tax and Transfer Pricing Law

The long wait was finally over on 9 December 2022, when the UAE Federal Tax Authority (FTA) released the final version of the UAE Corporate Tax (...

Summary of Public Consultation Document issued for UAE Corporate Tax

On 31 January 2022, the UAE Ministry of Finance announced the introduction of Federal Corporate Tax (CT) in UAE w.e.f. 1 June 2023. While the UAE...

Healthcare Supply Chain Excellence

In our podcast series, Healthcare...

Are you compliant with FATCA/CRS regulations in UAE?

Foreign Account and Tax Compliance Act (FATCA) is a US legislation that aims to combat tax evasion by US persons. In 2010, the US enacted FATCA ...

Intangible Asset Valuation – Valuing Customer Relationships

Intangible asset valuation is a complex process. Though these assets do not have any physical substance, they are at the heart of any ...

Women In Technology

Our Women in Technology Podcast Se...

UAE Introduces Corporate Income Tax

As expected, United Arab Emirates (UAE) have announced the introduction of Corporate Income Tax on 31 January 2022. As a signatory to the Two Pi...

Setting up Enterprise Analytics in 2022

Advanced Analytics, which includes Predictive Techniques, Machine Learning, and Artificial Intelligence, is leading the next wave of disruption. Us...

Enterprise Analytics 101 – Think Next!

Netflix uses its recommendation systems to keep you hooked. Uber uses real-time analytics to match you with fitting co-riders. Apart from these, on...

Enterprise Analytics 102 – People Matter!

As a generation growing up on science fiction, AI vs. homo sapiens always seemed like a near possibility. (hint – The Matrix). Will this be the n...

Enterprise Analytics 104 – Insights to Action!

Is the buzz around analytics dwindling? Once hyped as the gamechanger for every enterprise, is analytics letting businesses down now? While investm...

Enterprise Analytics 105 – The Feedback Loop

Amazon started as an online bookstore, and now, it has revolutionized the retail ecosystem completely. Netflix started as a DVD rental store, and n...

What business leaders need to know before setting up Enterprise Analytics in 2022

Artificial Intelligence (AI) is the buzzword nowadays. Organizations across the globe are pouring investments worth billions of dollars into data...

Events

-

25May

2021New Age Selling: A customer-centric approach to sales using AI

This webinar explores the role of analytics in driving sales transformation and the key challenges faced by sales leaders within an organization.

-

24Nov

2020Diversify to Differentiate – Think India, Think Next! – Success Showcase

This webinar covers advantages and key considerations, regulatory reforms, and incentive programs that have affected investing and FDI in India.