UAE Tax considerations for family foundation structures

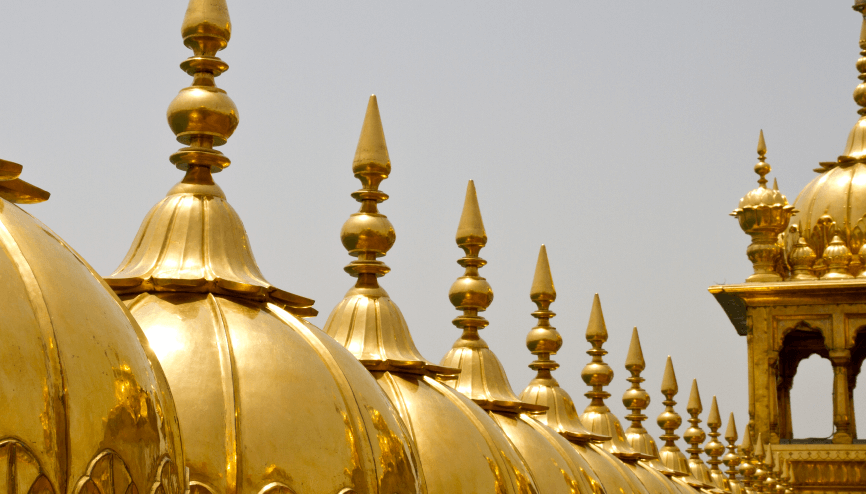

In UAE, Family Foundations have grown (in number) to become an integral part of the UAE's wealth management offering. A foundation, in principle, is a type of structure with a legal personality. A family foundation provides both non-residents and Emiratis, an attractive solution to manage their wealth, protect their assets, and make succession planning arrangements.

DIFC, the country’s premier financial hub alone has approximately 500 registered family foundations, and the number is growing very fast in light of the spurring interest shown by Ultra-High-Net-Worth Individuals (UHNIs) across the world.

In this article, Lokesh Gupta, underscores the impact of UAE Corporate Tax law on the Family foundation structure with below outline –

- Whether family foundations are regarded as taxable person under UAE CT law?

- Whether SPV’s held by family foundation enjoy the same status as Family foundation?

- Family foundation revenue streams and their tax incidence

- Compliance requirements for the family foundation structure