-

Are you struggling to run and maintain payroll and related compliances in-house?

-

Do you need a unified HR and payroll platform, and payroll services provider?

-

Are you sensitive about confidentiality, compliance, and queries from employees?

One of the major challenges for organizations in India is to track labor compliances across different regions of our country.

For international companies doing business in India, these challenges are more relevant. With the help of our India-specific payroll solution, businesses cannot only ensure growth and manage payroll expeditiously but also stay compliant.

Our focus is to make it easier for you to cut through the maze and concentrate on your core business by freeing you entirely from the burden of payroll processing, ensuring that your organization is compliant with hundreds of compliances on an annual basis.

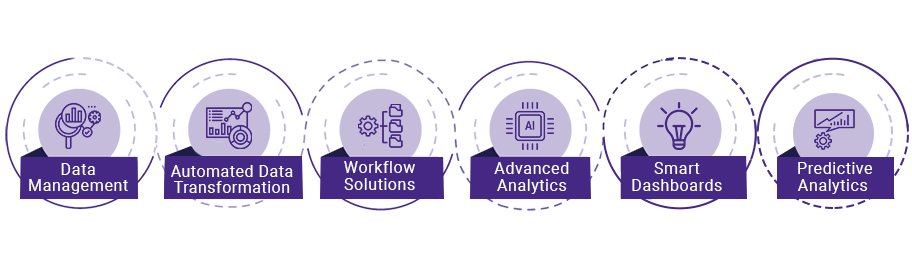

The Analytics-driven Approach

This approach allows businesses to comprehend data and use it to derive a sustainable competitive advantage. Predictive Analytics, Data-based Decisions, and Artificial Intelligence enabled processes are key enterprise-wide levers to drive effectiveness. Organizations relying on disparate data sources and legacy systems are likely to miss opportunities and may underperform.

Over Six Decades

of Experience

150+

Clients

10+

Countries

60+

Payroll Professionals

200,000+

Payslips

Partner-led

Approach

Payroll Processing

Payroll Processing Tax-Efficient Salary Structuring

Tax-Efficient Salary Structuring Payroll and Labor Compliances

Payroll and Labor Compliances Payroll Management Reports

Payroll Management Reports

Employee Query Helpdesk

Employee Query Helpdesk Employee Expense Reimbursements

Employee Expense Reimbursements Employee Benefits Management

Employee Benefits Management Employee Handbook Support

Employee Handbook Support

Our Capabilities

Explore what we specialize in

What do our clients say about us?

How We Supported and Benefited Our Clients

Pan India coverage for payroll and labor compliances (including advisory services) for clients

Design and set up of ’hire to retire’ processes, HR policies, and benefit planning, for MNCs

Salary, tax planning, and tax return filing support to inbound expats for home as well as host countries

HR, tax and benefits, and induction training for employees periodically

Salary, tax, and benefits planning for CXOs, country heads, for Indian subsidiaries of global companies

Planning (with specific reference to ESOPs or share purchase schemes) for domestic employees and expatriates

Information Security

Management System

under ISO 27001:2013

Personal Information

Management System

under BS 100123

Quality

Management System

under ISO 9001:2015